Tether invests $150 million in Gold.com

Tether, issuer of the top stablecoin USDT and gold-backed token XAU₮, agreed to invest $150 million to acquire 3.371 million shares (about a 12% stake) of Gold.com (GOLD). Most people will associate Gold.com with it’s subsidiaries JM Bullion, Monex, etc. The deal gives Tether the right to nominate a board member and includes plans for a $100 million gold leasing facility and partnerships including accepting and promoting Tether stablecoins. Gold.com will invest $20 million of the proceeds in XAU₮.

China cracks down on crypto (again)

China has tightened curbs on cryptocurrencies and tokenized real-world assets, barring domestic entities from issuing digital tokens overseas without approval and banning the offshore issuance of yuan-linked stablecoins, citing risks to monetary sovereignty. Put simply, China is trying to stop Chinese-linked companies from creating crypto tokens outside China to dodge domestic rules. Read more →

The news falls on the heels of U.S. Treasury secretary Scott Bessent telling lawmakers that he "would not be surprised" if China was exploring ways to challenge U.S. crypto dominance.

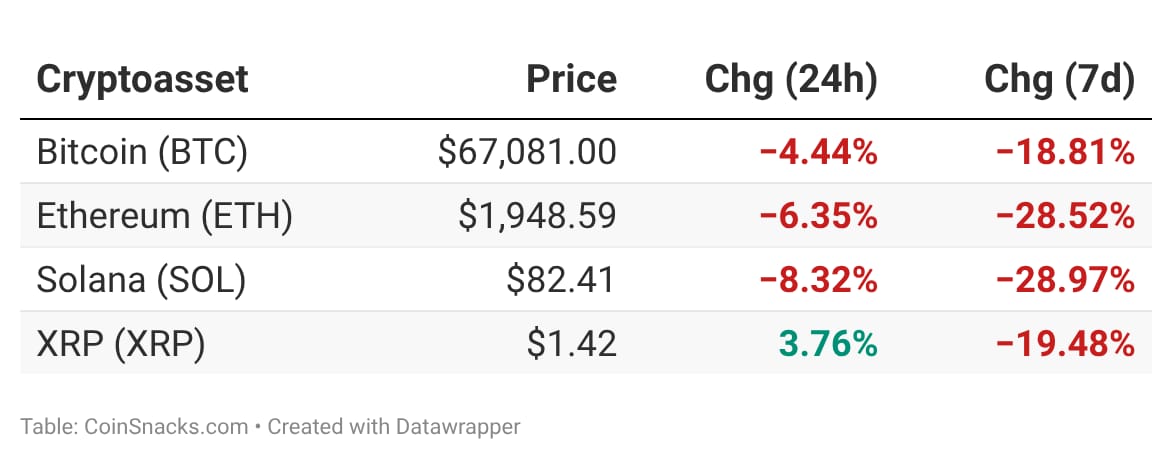

Rough day on the markets

Bitcoin fell ~17% yesterday, charting a $10,000 swing in less than 12 hours. It was one of the worst single-day drops in crypto history. While BTC has climbed back to over $65,000, many woke up this morning asking the same question we had: what was that all about?

So far, the most plausible rumor is pointing to a Hong-Kong based hedge fund running IBIT options blowing up. Notably, yesterday was the highest volume day on IBIT ever. Not by a little either – by a factor of nearly 2x. Read more →

This Critical Mineral's Up 122% in the Last 12 Months (From EnergyX)

When Bitcoin bounces, this altcoin could explode (From Crypto 101)

📥️ Want to advertise in CoinSnacks? Learn More