The standout assets of 2025… gold and silver.

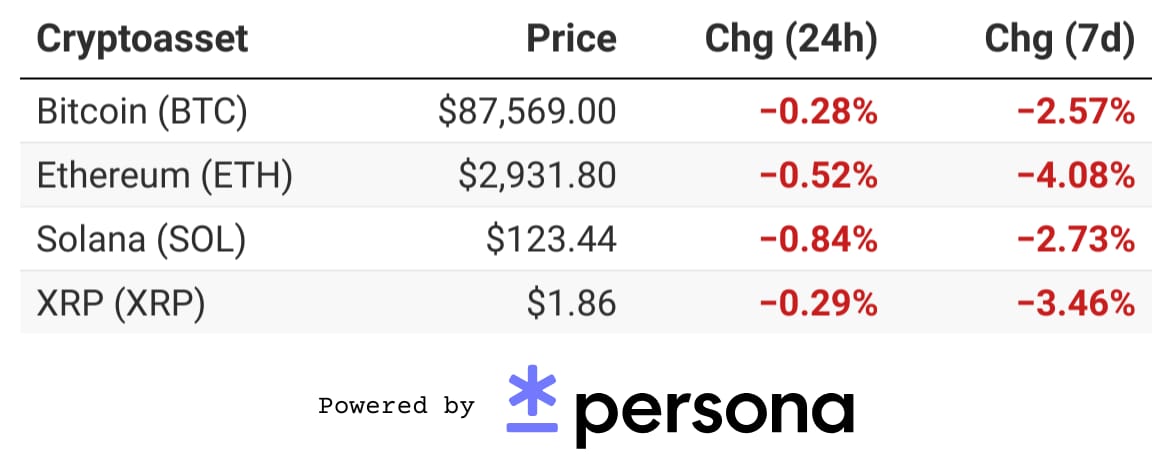

Gold is having its best year since 1979, up more than 60% YTD. Silver has done even better, rallying nearly 140% YTD and about 20% in the past month alone, reaching a record $79 on Friday. BTC meanwhile is down 6% YTD. It’s why we have continuously told readers not to be myopically obsessed with crypto at the exclusion of commodities.

BitMine begins ETH staking as it crosses 3.4% of supply

Bitmine Immersion Technologies (BMNR) added another 44,463 ETH over the past week, pushing its total holdings to ~3.41% of circulating supply. The accumulation follows the company’s announcement last week that it crossed 4 million ETH in holdings, as it continues it’s strategy to acquire 5% of the network’s total supply. The company has also begun staking a portion of its holdings (408k ETH), as it works toward launching its Made in America Validator Network in early 2026. Read more →

China's digital yuan to become interest-bearing next year

China is turning the e-CNY from “digital cash” into interest-bearing “digital deposits.” Starting in 2026, e-CNY held in wallets will earn interest tied to demand deposit rates – a move state media says would make it the first interest-bearing CBDC. Zooming out, Beijing is betting yield is the adoption catalyst its CBDC has lacked. And in a roundabout way, this could influence policy in the U.S. Currently, under the GENIUS Act, regulators have kept stablecoins cash-like by barring issuers from paying interest/yield, even though exchanges can effectively “pass through” rewards. Read more →

📥️ Want to advertise in CoinSnacks? Learn More